Year End Procedures

![]()

The

following instructions outline the process to follow when your firm is ready to

roll its year end:

When all the transactions for December

of the current year have been entered, run all of

the balancing reports that you would run at a regular month end.

Access the Maintain

GL Posting Parameters form. The path to this form is as follows:

Maintenance/System Admin/Parameters/Maintain GL Posting Parameters

Two choices are available for rolling the

month:

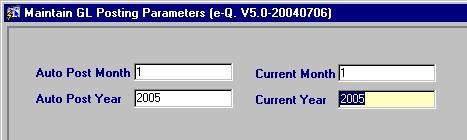

Close December (month

12) completely by setting the Auto Post Month and

Current Month settings

to "1" and the Auto Post Year and

Current Year to the new

year.

OR

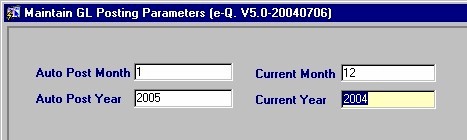

Keep December (month 12) open for accounting entries and open

January

for the auto time and bill posting by secretaries and lawyers. Do this by

setting the Auto Post Month to "1", leaving the Current

Month as "12", setting the Auto Post Year to the

number for the new year, and leaving the Current Year as the

number for the year that is closing. This

will allow accounting staff to enter transactions for both December and January while any

Time and Bill

posting done by other Timekeepers will go to the Auto Post Month of "1"

(January).

If

your Firm has a Year End date that does not coincide with the end of the

Calendar year, then normal Month End procedures apply at the end of

December; the procedures outlined above should be followed at the end of

which ever Calendar month represents you Firm's Fiscal year end.

When

you are ready to roll the year (whether a year end of December 31 or any other

month), the user must:

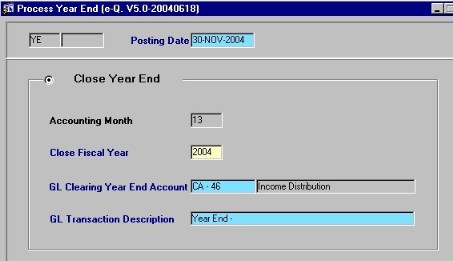

Access

the Process Year End form. The path to this form is as follows:

Maintenance/System Admin/Process Year End/Process Year End

Confirm

that the proper information is displaying in the following fields:

Posting

Date

Close

Fiscal Year

(the fiscal year you are about to roll)

GL

Clearing Year End Account

(the GL account that the revenue and expense accounts will be cleared to.

Note that this account defaults from the settings in the Maintain GL Control Accounts form.)

GL

Transaction Description

(the default is "Year End - ", but

the user may enter a new description).

Once

the user is satisfied with the data

displayed in this form, they may then click the Save button on the

menu bar or press [F10]. Keep in mind that all of the year end transactions are being posted to

month 13 of the year that is closing.

The

following is an explanation of Month 13 and why year end closing

transactions are posted to this month:

All the year end transactions are kept isolated from

your regular December (or month 12) transactions. Operating statement comparisons will reflect accurate

balances for “Previous Year” instead of showing zeroes at the end of month

12.

All GL reports may be run for month

13.

If any adjusting entries are required after the closing of

the year, they

can be done with journal entries

to December (or month 12) of the closing year. To access the Post

Journal Entries form, follow the path Posting/Other Posting/Post Journal

Entries.

If entries are made after

the year end has been run, the user will need to reverse the Year End process and then rerun it, thereby

updating the transactions into month 13 of the closing year. Reports may then be run again.

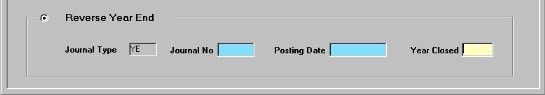

To reverse the year

end, the user must access the Process Year End form (Maintenance/System

Admin/Process Year End/Process Year End) and select the Reverse Year

End option in the bottom block of the form.